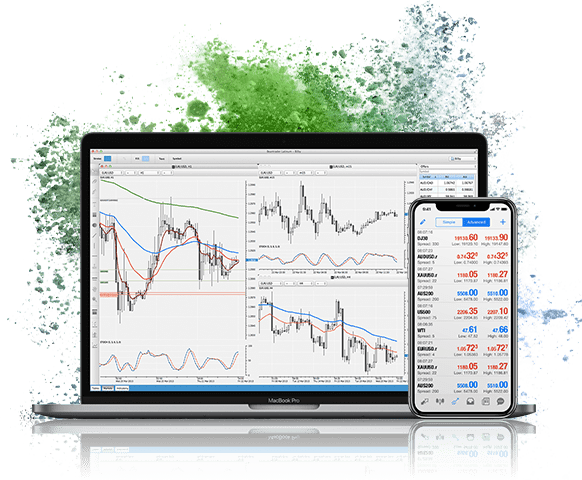

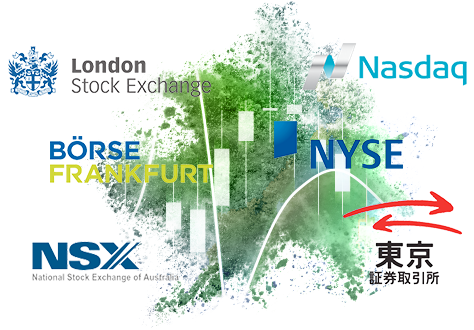

IVT Markets provides exposure to the major global stock indices through index Contracts for Difference (“CFDs”), at competitive leverage on world-class trading platforms. Online CFD indices trading is a great way to participate in the top global stock markets. With IVT Markets, you can trade CFD indices futures from across the world at margins starting at just 1%. Trade AUS200 cash indices at AU$1 per point. Stay on top of overseas stock index movements with access to NASDAQ 100, S&P 500, EUREX, indices and more.

We’ve partnered with leading banking and non-banking financial institutions to ensure a deep liquidity pool, so that you get the best available market prices and ultra-low latency order execution.

IVT Markets offers much more than Indices trading! We also offer Forex, Commodities,

Shares & Cryptocurrencies on competitive spreads in unparalleled trading conditions.

Benefit from our low-cost, competitive margins, starting at just 1%.

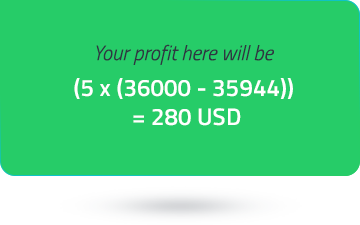

With an exposure of $1 per point movement, cash index contracts allow you to precisely tailor your position size according to your risk management profile.

The cost of cash index contracts is built into the bid-offer spread.

Diversify your portfolio by trading CFD indices and hedge your risks.

Every stock exchange in the world has a benchmark stock index, while some have several. These baskets of individual stocks are often ranked by independent institutions, like major banks or specialist companies like the FTSE Group or the Deutsche Börse. They also come in different sizes. For instance, the FTSE 100 tracks the share price of the top 100 companies listed on the London Stock Exchange, in terms of market capitalisation. The ASX 200 tracks the share price of the 200 top companies listed on the Australian Securities Exchange (ASX), while the SPI 200 futures contract is a benchmark equity index futures contract, based on the ASX 200 index.

It is impossible to track all the companies listed on a stock exchange, which is why traders resort to index trading. Through trading indices, they are able to measure the overall performance of the stock market of the country and the economy in general. Traders speculate on the price movements of these financial instruments indices to earn returns when the indices rise in value.

In this case, the price moved in your favor. But, had the price declined instead, moving against your prediction, you could have made a loss. This continuous evaluation of price movements and resultant profit/loss happens daily. Accordingly, it leads to a net return (positive/negative) on your initial margin. In the loss scenario where your Free equity, (account balance + Profit/Loss) falls below the margin requirements (896.6), the broker will issue a margin call. If you fail to deposit the money, and the market moves further against you, when your free equity reach the 50% of your initial margin the contract will be closed at the current market price, known as “stop out”.

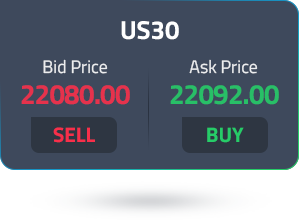

Notice how a small difference in price can offer opportunities to trade? This small difference is known as “pip” or “percentage in point”. For Indices trading, 1 pip is equal to a price increment of 1.0 which is also called an Index point.

| If the price of US30 | To | You could Gain or Lose for a Long Position | Resulting in a Return of the Initial Margin |

|---|---|---|---|

| Rises by + 1% | 36222.64/36224.64 | USD 358.64 | 40% |

| Declines by -1% | 35505.36/35507.36 | USD -358.64 | 40% |

With thousands of stocks trading across different exchanges, stock indices provide an accurate and reliable way to gauge the overall market sentiment. They can also act as benchmarks against individual stock portfolios.

They can offer exposure to an entire sector in a country. You do not have to perform thorough research on individual companies and other fundamentals. You can simply take a bullish or bearish position, depending on the overall market direction. They reduce the risk of a single company’s performance impacting your entire portfolio.

Price movements of indices are smoother, since individual stock performances cannot lead to intense spikes in volatility. But this volatility is sufficient for you to pick out numerous trading opportunities. There is a lot of activity that happens on individual stocks to produce ample index volatility. Indices trading can be suitable to traders of all styles and a variety of trading strategies, since indices reflect the broader effects of economic and political shifts.

Segregated client funds

Market leading spreads from 0.0 pips, 24/5

Low latency, ultra-fast execution under 40ms

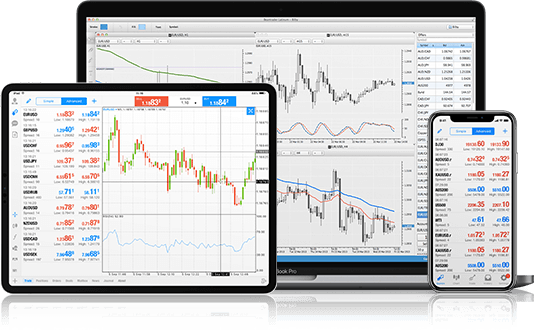

MT4, MT5 & WebTrader with superior client portal

Award-winning support & personal account managers

15+ years trading experience

| Symbol | Product | Standard A/c Min | Standard A/c Avg |

|---|---|---|---|

| AUS200 | Australia 200 Index vs Australian Dollar Cash | - | 1.62 |

| CHINA50 | China A50 Index vs US Dollar Cash | - | 8.13 |

| EURO50 | Euro 50 Index vs Euro Cash | - | 1.83 |

| FRA40 | CAC 40 Index vs Euro Cash | - | 1.81 |

| GER40 | German 40 Index vs Euro Cash | - | 1.29 |

| HK50 | Hang Seng Index vs Hong Kong Dollar Cash | - | 5.92 |

| ITA40 | Italy 40 index vs Euro Future | - | 14.65 |

| JP225 | Japan 225 Index vs Japanese Yen Cash | - | 5.71 |

| SPA35 | Spain 35 Index vs Euro Cash | - | 6.6 |

| UK100 | UK100 Index vs British Pound Cash | - | 1.47 |

| US100 | US Tech 100 Index vs US Dollar Cash | - | 1.51 |

| US30 | US 30 Index vs US Dollar Cash | - | 1.54 |

| US500 | US 500 Index vs US Dollar Cash | - | 0.5 |

| USDX | USD Index Basket vs US Dollar Future | - | 0.05 |

| VIX | VIX Index Cash vs US Dollar Future | - | 0.15 |

| Available Indices | ||

|---|---|---|

| NASDAQ 100 E-Mini | DJIA E-Mini (CBOT) | Mini SPI 200 |

| Nikkei 225 (CME) | DAX Index | SPI 200 |

| S&P 500 E-Mini | EURO Stoxx 50 |

If you hold an open Long position on a Cash Index CFD contract that pays a dividend, you will be entitled to an amount equal to the amount based on the number of contracts you hold after the close of the business day before the ex-dividend date.

Conversely, if you hold an open Short position in a Cash Index CFD which pays a dividend, you will be required to pay an amount based on the number of contracts you hold after the close of the business day before the ex-dividend date. This adjustment may be made either as a cash adjustment into your MetaTrader 4 or MetaTrader 5 trading account or included into the end of day swap rate.

In this method, the stocks listed on the Index are weighted using the market capitalisation of each company. The S&P 500 and ASX 200 are major Indices that employ this method.

As indicated by its name, equal weightage is given to all the stocks based on their returns. The returns on each stock are calculated, added together and then divided by the total number of stocks on the Index.

This model uses the price of applicable stocks to get a weighted average. Stocks with a higher share price are given greater weight, irrespective of market capitalisation. The Dow Jones in the United States uses the price weighted method.

Dow Jones: The Dow Jones Industrial Average often referred to as ‘the Dow’, is a price-weighted index of the 30 largest companies listed on stock exchanges in the United States. Salesforce, Boeing and Walt Disney are among the companies that make up the index.

S&P 500: Tracks the 500 largest US stocks and is weighted by market capitalisation. Well known companies on the S&P 500 include Amazon, Apple, Microsoft, Alphabet and Tesla.

FTSE 100: Is made up of the 100 largest stocks by market capitalisation on the London Stock Exchange. It is commonly referred to as the Footsie and includes major financial institutions such as Lloyds and Barclays.

ASX 200: Also weighted using market capitalisation, the ASX 200 is also maintained by Standard & Poor’s and is the benchmark for equity performance in Australia.

Movement in its Constituents: Significant price movement in the stocks included in a particular index is the biggest reason for a change in the value of the index.

Economic News and Data: Market news relating to economic data can affect stock markets and their benchmark Indices. This includes releases of key economic data relating to inflation, unemployment, and futures markets. Key information can be found in the Economic Calendar.

Political News: Elections, changes to monetary policy and trade relations are among the political factors that can impact financial markets and key components of them such as Indices.

Changes in Composition: The addition or removal of stocks from an index can cause fluctuations in its value.

Sector Specific: There are a wide range of sector specific Indices such as the NASDAQ 100 which does not include any companies from the financial industry.

Trading opportunities: Through CFDs, traders can benefit from both rising and falling Indices prices.

Hedging: Indices can be particularly useful for hedging strategies as you can invest in an index of a particular sector. If the portfolio of a trader was made up of stocks from the financial sector, they could trade the NASDAQ 100 to counter any significant price movements in their current portfolio.

Diversification: Indices CFDs allow traders to gain exposure to global markets without having to invest in individual stocks. Australian traders can invest in the DAX 30 (Germany) or the Hang Seng (Hong Kong) to gain exposure to other markets.

Leverage: The ability to trade using leverage is one of the key attractions of CFD trading. Traders can open positions of a much higher value than the funds available in their trading account. Learn more about Margin Trading.

Indices are an important part of global investment. They are used as a benchmark to gauge the performance of an overall market, or a specific sector of a market. Indices show trends and changes in investing patterns. Calculated using an array of different methods, investors often use them as part of their trading strategy.

Trading Costs: With CFD trading you do not take ownership of the underlying asset. This reduces the overall costs associated with trading.

Less Volatile: As they are made up of a number of different stocks, Indices are not as susceptible to sharp changes in value.

Leveraged Trading: Enables traders to gain larger exposure to Indices by depositing only the margin required to open the trade, rather than the full value of the position.

Find out more about the Benefits of Indices CFDs and how to trade them.

By accurately predicting the price movement of an index you can gain a profit. One of the key advantages of trading cash index CFDs is that you can open long and short positions. This means traders are able to benefit from both rising and falling values of Indices. Read our Beginner's Guide on Index Trading.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.