A bond is an over-the-counter exchange-traded fund (ETF) and fixed-income financial instrument issued by corporations and governments (IOU) as debt securities (Coupon and Zero-coupon bonds) for a period of time mainly to pay down other debts and operations funding purposes through brokerage firms in the secondary market.

Bond trading is when bond investors and traders (lenders) are allowed to buy or sell corporate bonds and government bonds (bond issuers) in the bond market (public debt market). The issuer (borrower) must pay back the bond price (face value), interest rate, and a fixed or variable interest payment (dividend) to the bondholders on the bond maturity date. Traders consider bond investing one of the most effective portfolio diversification strategies.

Volatility is lower in the bond markets than trading stock and other markets because bonds provide a predictable income flow – bond coupon – as fixed-income securities. However, bonds with lower coupon rates are more volatile than bonds with higher coupon rates.

Μost investors tend to trade bonds as an effective portfolio diversification strategy benefiting from the bond markets reduced fluctuations, liquidity and risks given the low volatility of bonds trading, an individual bond’s known details and fixed coupon payments. To achieve proper portfolio diversification, investors often hold their bond CFDs to maturity in order to secure their funds and potential profits since the original sum invested in bonds trading will be paid back by the bond issuer.

Yet, risks are always present when trading, whatever the type of investment. Bond prices can be negatively affected when governments and corporations issue new bonds or risk default events. Traders can also use Bonds trading to pick up bond yields by trading volatility (spread betting strategy) or seize any potential bond price increase from a credit upgrade. Bond CFDs offer traders the possibility to re-sell bonds when interest rates are increasing without the need to hold onto them until the maturity date.

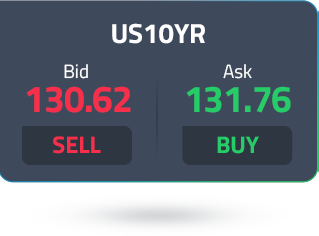

| Symbol | Product | Min | Avg |

|---|---|---|---|

| GILT | UK Long Gilt | - | 0.11 |

| US10YR | US 10yr T-Note | - | 0.12 |

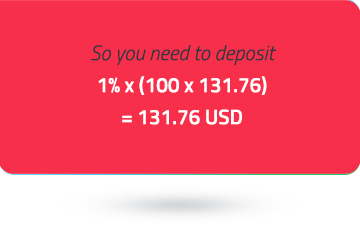

Contracts for Difference in bonds trading (Bond CFD) allow investors to trade on the price of the fixed-income security - issued by governments, corporations and other institutions as debt obligations - without purchasing the actual underlying asset. Bond CFDs are made available to traders through brokerage firms in the secondary market and are mainly used as long-term investments, portfolio diversification and spread betting strategies. Bond CFDs offer traders the possibility to re-sell bonds when interest rates are increasing without the need to hold onto them until the maturity date.

Governments, corporations and other institutions issue bonds (debt obligations) in the public debt markets for a fixed period of time to finance their projects and honour other liabilities. Bonds are made available in the secondary market through brokerage firms. Traders can benefit from the bond price, the bond market volatility, coupon payments (dividends), bond yield and potential credit upgrades. The issuer (borrower) must pay back the bond price (face value), interest rate, and a fixed or variable interest payment (dividend) to the bondholders on the bond maturity date.

High Bond Yields - Low Bond Prices

Low Bond Yields - High Bond Prices

Treasury bonds and agency bonds are short-term (1-5 yrs), intermediate-term (5-12 yrs), and long-term investments (12-30 yrs). A bond rate is fixed at its purchase, and the bond issuer must pay interest regularly until the bond maturity, in which the original sum of the investment must be paid back to the bondholders in addition to a variable or fixed interest. Bond investing is used as an effective portfolio diversification strategy, used to pick up bond yields by trading volatility (spread betting strategy) and seize any potential bond price increase from a credit upgrade. Bond CFDs offer traders the possibility to re-sell bonds when interest rates are increasing without the need to hold onto them until the maturity date.

Bond trading allows traders to re-sell before the maturity date and is mainly used as a portfolio diversification and spread betting strategy (pick up bond yields) due to less volatility and fewer risks. Bond investing offers the possibility to benefit from potential credit upgrades, bond price movements, and fluctuations since traders can re-sell bonds when interest rates are increasing without the need to hold onto them until the bond maturity date. Investors usually find suitable bond funds and hold them for the long term.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.

Risk Warning: Trading Forex and IVT carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and IVT may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary. Please read and ensure you fully understand our Risk Disclosure.

You must be 18 years old, or of legal age as determined in your country. Upon registering an account with IVT Markets, you acknowledge that you are registering at your own free will, without solicitation on behalf of IVT Markets.