IVT Markets offers you exposure to the most popular precious metals with consistently tight pricing.

IVT Markets allows trading the spot price for metals including Gold or Silver against the US Dollar or Australian Dollar as a currency pair on 500:1 leverage.

Open a trading account with IVT Markets, and you will gain exposure to the available global market prices on trading gold CFDs and silver CFDs. Trading metal CFDs with IVT Markets, a global regulated, multi-award-winning broker.

Discover the benefits of trading Metals on one of the most powerful trading platforms available, MetaTrader 4 (MT4). Available across desktop and mobile platforms the MetaTrader 4 platform is ready when you are.

Segregated client funds

Market leading spreads from 0.0 pips, 24/5

Low latency, ultra-fast execution under 40ms

MT4, MT5 & WebTrader with superior client portal

Award-winning support & personal account managers

15+ years trading experience

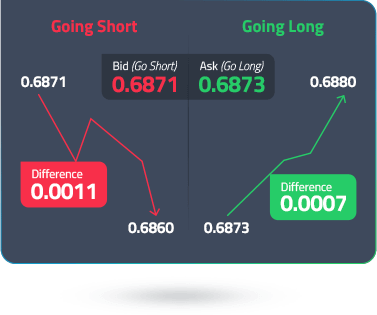

At IVT Markets, we offer you exposure to the most popular precious metals that make up an important commodity asset class. Metals trading is closely linked to the outlook for the overall global markets and major currencies and metals are traded against major currencies in a similar way to other currency pairs on the platform.

Factors affecting precious metal prices include supply and demand, interest rates, economic uncertainty, industrial output and the strength of the dollar with precious metals like gold traditionally viewed as a safe haven in times of volatility. Traders can trade metals to express their outlook on certain industries or to hedge their trading portfolio.

Through careful analysis, CFD traders predict the potential direction of metals prices and attempt to capture gains based on price fluctuations in the short-term or long-term. The market is open 24 hours a day, 5 days a week.

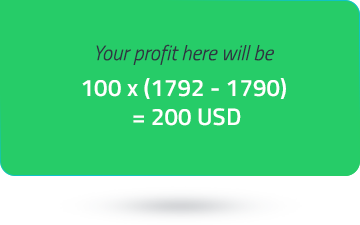

| If the price of XAUUSD | To | You could Gain or Lose for a Long Position | Resulting in a Return of the Initial Margin |

|---|---|---|---|

| Rises by 1% | 1809.92/1810.02 | USD 1792 | 500% |

| Declines by 1% | 1774.08/1774.18 | USD -1792 | -500% |

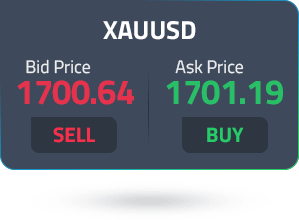

| Symbol | Product | Standard A/c | Raw ECN A/c Min | Raw ECN A/c Avg |

|---|---|---|---|---|

| XAGAUD | Silver vs Australian Dollar | 0.03 | 0.008 | 0.024 |

| XAGEUR | Silver vs Euro | 0.02 | 0.004 | 0.014 |

| XAGUSD | Silver vs US Dollar | 0.02 | 0 | 0.015 |

| XAUAUD | Gold vs Australian Dollar | 0.51 | 0.06 | 0.41 |

| XAUEUR | Gold vs Euro | 0.34 | 0 | 0.16 |

| XAUUSD | Gold vs US Dollar | 0.21 | 0 | 0.07 |

| XPDUSD | Palladium vs US Dollar | 10.62 | - | - |

| XPTUSD | Platinum vs US Dollar | 3.25 | - | - |

| XPBUSD | Lead vs US Dollar | 4.65 | 2.38 | 4.64 |

| XZNUSD | Zinc vs US Dollar | 4.4 | 2.45 | 4.39 |

| XNIUSD | Nickel vs US Dollar | 29.91 | 9.22 | 29.8 |

| XALUSD | Aluminum vs US Dollar | 4.75 | 2.13 | 4.73 |

| XCUUSD | Copper vs US Dollar | 6.11 | 2.98 | 6.1 |

| XAUGBP | Gold vs British Pound | 0.19 | 0.04 | 0.18 |

| XAUSGD | Gold vs Singaporean Dollar | 0.47 | 0.06 | 0.45 |

| XAGSGD | Silver vs Singaporean Dollar | 0.02 | 0 | 0.019 |

| XAUCNH | Gold vs Chinese Yuan | 2.31 | 0.66 | 2.3 |

Supply and Demand: Applicable across all products and services, the same also applies to precious metals. A shortage in metals or the increased demand for their use can affect prices. Let’s take industrial metals such as copper or aluminium. A technological advancement may create an alternative for their use and decrease their value.

Macroeconomic Variables: Data relating to interest rates and GDP affect a significant amount of metals. One of the reasons is because metals are seen as a safe-haven, and an alternative investment to the cash rate provided by financial institutions.

Market Conditions: FP Markets provides metals trading against many major currencies including the US dollar, similar to foreign exchange. Metals tend to be susceptible to the US dollar and have historically traded in the opposite direction to the greenback. This is why they are often used as part of a hedging strategy in times of economic uncertainty.

Inflation: Anything that dilutes the value of a currency helps the performance of metals. Quantitative easing or the printing of additional money causes a rise in inflation with metal prices generally following suit.

Metals CFDs: As you do not have to not actually own the underlying asset when trading CFDs, there are fewer costs associated with investing in metals this way. There is no need to store the asset and traders can benefit in both rising and falling prices. The prices are comparable to those found on the London Metal Exchange (LME), the world’s largest market for ETFs on base metals and other metals.

Portfolio Diversification: With limited correlation to other financial instruments such as stocks and bonds, trading precious metals is a useful way to diversify your portfolio.

Hedging: Precious metals are often used as part of a risk management strategy. Investors often trade metals to hedge against inflation and currency.

Safe-Haven: During times of economic uncertainty, the value of precious metals tends to rise. This has historically been the case during economic slumps and key political events including major elections.

With respect to Metals CFDs, Gold is the most traded commodity. Platinum, palladium and silver are among the other most traded metals. They can all be traded with IVT Markets. Find out more about Investment Strategies For Metals.

As indicated by their name, precious metals are indeed that. They are rare which prevents the prospect of excessive supply and have an infinite lifespan as they do not rust. The fact that they are measured in troy ounces makes it easy to compare their value.

The History Of Metals dates back thousands of years. Apart from being a medium of trade and exchange, precious metals have been considered as a long-term store of value for an extended period of time.

Some of the factors to consider prior to investing in precious metals include the current geopolitical situation, that state of the US dollar, the position of central banks and inflation rates.

To get a better understanding of this asset class, read our guide on Investing In Precious Metals.

The History Of Metals dates back thousands of years. Apart from being a medium of trade and exchange, precious metals have been considered as a long-term store of value for an extended period of time.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.